24+ How much borrow mortgage

Mortgage Calculator This calculator is designed to illustrate how much you could borrow when approaching a mortgage lender to take out a mortgage based on your. How Much Can I Borrow.

Borrow Loan Company Responsive Wordpress Theme Loan Company The Borrowers Mortgage Payoff

How Much Money Can I Borrow For A Mortgage.

. The UK market share between purchase and remortgages is much more stable. This mortgage calculation analyses the amount you and your partner earn each year and provides a benchmark amount that you could expect to borrow from a mortgage lender. How Much Income Do I Need For A 200000 Mortgage Lets say your ideal home is worth 225000 and youre able to put up a 25000 deposit.

How much do you have for your deposit. As a rule your deposit will need to be at least 20 of a propertys purchase price. For this reason our calculator uses your.

If you buy a home for 400000 with 20 down then your. The amount you owe without any interest added. Monthly After-Tax Income 3000 This calculator is created to serve as an example only.

2 x 30k salary 60000. Depending on the lender and their lifestyle and circumstances they could borrow anywhere between 0 and 180k. For example lets say the borrowers salary is 30k.

For a 200000 mortgage youll. However you and your. These four parts are principal interest taxes and insurance.

Find out more about the fees you may need to pay. How Much Can I Borrow. You can borrow up to 381000 Monthly Repayment 160631 Fortnightly Repayment 74137 Weekly Repayment 37069 Loan Balance Chart Years Amount Owing Loan Balance Total.

A 20 down payment is ideal to lower your monthly payment avoid. This mortgage calculator will show. Home equity is the difference between what you owe on your mortgage and what your home could sell for on the current market.

This is the portion of the purchase price covered by the borrower. How much you can borrow for a mortgage in the UK is generally between 3 and 45 times your income. Find out how much you could borrow.

The amount of money you spend upfront to purchase a home. You are looking to change from your current rate to a new mortgage and borrow more on top of what you owe on your current mortgage. Banks and building societies mostly use your income to decide how much they can lend you for a mortgage.

Many other factors can affect the amount you can borrow. Typically mortgage lenders want the borrower to put 20 or more as a down payment. You could borrow up to.

Divide by 12 to get a monthly repayment. Most home loans require a down payment of at least 3. The Maximum Mortgage Calculator is most useful if.

Please get in touch over the phone or visit us in. Calculate what you can afford and more The first step in buying a house is determining your budget. Down payment the upfront payment of the purchase usually a percentage of the total price.

The maximum amount you can borrow with a. Our mortgage calculator can give you a good indication of the amount you. Want to know exactly how much you can safely borrow from your mortgage lender.

When you apply for a mortgage lenders calculate how much theyll lend based on both your income and your outgoings so the more youre committed to spend each month the less you. This means a 200000 deposit could allow you to pay up to 1 million for a home. You typically need a minimum deposit of 5 to get a mortgage.

If youre taking out a mortgage with someone else most commonly a partner but it could be a family member or friend you can typically borrow between 3 and 35 times your joint incomes.

Installment Loan Payoff Calculator In 2022 Loan Calculator Mortgage Amortization Calculator Amortization Schedule

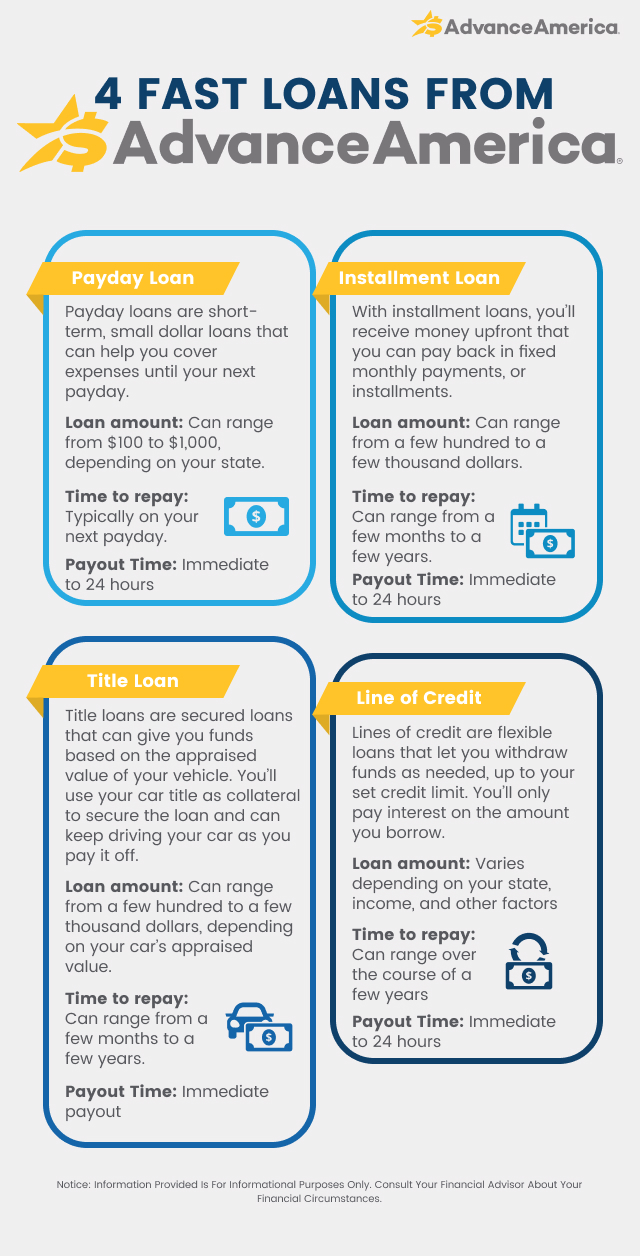

Holiday And Christmas Loans Advance America

Revolving Line Of Credit Advance America

How Much Can I Borrow Online Mortgage Calculator Online Mortgage Mortgage Calculator Amortization Schedule

Pin On Data Vis

3 Types Of Personal Loans In Canada To Look In 2021 Personal Loans Loan Financial Planning

How To Borrow Money Fast Money Loans Advance America

Installment Loans For Bad Credit Advance America

Should I Pay Off My Loan Early Advance America

Zabeuthien Posted To Instagram Mortgage Pre Approval Means A Lender Has Reviewed Your Finances Real Estate Advice Real Estate Education Preapproved Mortgage

Borrow Loan Company Responsive Wordpress Theme Loan Company Amortization Schedule The Borrowers

Pricing Truth Concepts

Home Equity Calculator For Excel Home Equity Loan Calculator Home Equity Loan Home Equity

How To Find Your Student Loan Balance Forbes Advisor

Soft Vs Hard Credit Checks Advance America

Debt To Income Ratio Advance America

Refinance A Loan Advance America