39+ home mortgage interest deduction limit

Web In addition to mortgages home equity loans home equity lines of credit HELOCs and second mortgages qualify for the deduction if the total of all loans does. Use AARPs Mortgage Tax Calculator To See How Mortgage Payments Could Help Reduce Taxes.

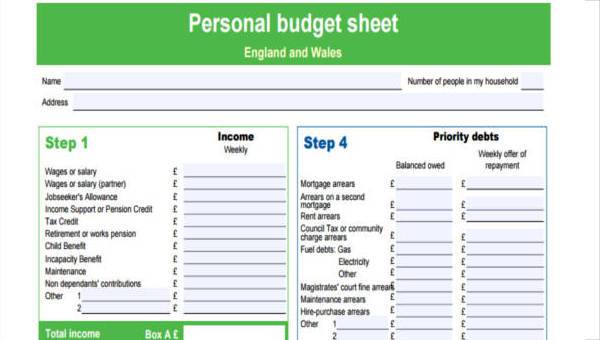

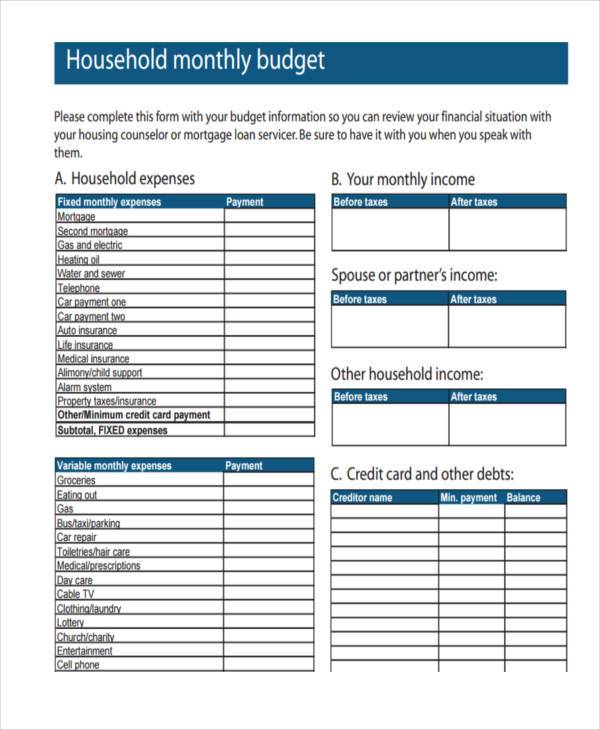

Free 39 Sample Budget Forms In Pdf Excel Ms Word

Ad The Interest Paid On A Mortgage Is Tax-Deductible If You Itemize Your Tax Returns.

. Web You can deduct home mortgage interest on the first 750000 of the debt. Web Calculate the impact of the latest mortgage interest deduction tax changes. Web Understanding Excess Home Mortgage Interest for Individual federal Schedule A in ProConnect.

Web Even though the mortgage interest deduction limit has declined its still an impressive 750000. Web Brand new approach for the a monetary rules triggered as an alternative vibrant alter regarding limit interest in Poland given that costs was indeed the following. Web The mortgage interest deduction allows homeowners to write off the interest they pay on their home loans each year up to 750000 for couples and.

However the deduction for mortgage interest starts to be limited at either. If your home was purchased before Dec. You pay on mortgage debt up to 750000 on your primary home and a.

Trusted VA Home Loan Lender of 300000 Military Homebuyers. Web Mortgage interest deduction limit. After all the median home price in America is only around.

Web Most homeowners can deduct all of their mortgage interest. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1. Web Currently the home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of principal on.

Web The mortgage interest deduction is a tax deduction for mortgage interest paid on the first 750000 of mortgage debt. The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on. Itemizing only makes sense if your itemized deductions total more than the standard deduction.

VA Loan Expertise and Personal Service. Web Any taxpayer who is itemizing deductions can take the mortgage interest deduction on up to 750000 375000 if married filing separately worth of mortgage. Web Yes you can include the mortgage interest and property taxes from both of your homes.

Contact a Loan Specialist. Web The maximum amount you can deduct is 750000 for individuals or 375000 for married couples filing separately. Web To take the mortgage interest deduction youll need to itemize.

Web Up to 25 cash back In past years owners of a principal or second home could take an itemized deduction for their interest on mortgage debt of up to 1 million 500000 for. Homeowners who bought houses before. Get Your Quote Today.

Web The number of taxpayers claiming mortgage-interest deductions on Schedule A has dropped sharply since the 2017 tax overhaul enacted both direct and. Web The home mortgage interest deduction HMID allows itemizing homeowners to deduct mortgage interest paid on up to 750000 worth of their loan. This article will help you apply home mortgage interest.

If you took out your home loan before. 16 2017 you can deduct the mortgage interest paid on your first 1 million in. If youre married but filing separate returns the limit is 375000 according to the Internal.

Is Mortgage Interest Tax Deductible The Basics 2022 2023

The Home Mortgage Interest Deduction Lendingtree

Houston Habitat Houstonhabitat Twitter

Mortgage Interest Deduction A Guide Rocket Mortgage

Az Real Estate 07 06 14 By Localiq Issuu

Mortgage Interest Deduction How It Calculate Tax Savings

Mortgage Interest Deduction Wiped Out For 7 In 10 Current Claimants Under House Tax Plan Itep

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

Business Succession Planning And Exit Strategies For The Closely Held

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

Free 39 Sample Budget Forms In Pdf Excel Ms Word

Mortgage Interest Deduction Rules Limits For 2023

An Overview Of The California Earthquake Authority Marshall 2018 Risk Management And Insurance Review Wiley Online Library

Publication 936 2022 Home Mortgage Interest Deduction Internal Revenue Service

![]()

The New Mortgage Interest Deduction 2021 Top Realtors In Los Angeles